PayShap Benefits – Is it better than a bank account or cash

PayShap is a new payment system that launched in South Africa on 13 March 2023. The new rapid payment system was launched by a collaboration between BankservAfrica and the South African Reserve Bank (SARB), which aims to revolutionise small-sum transactions in South Africa.

READ: all about PayShap

PayShap have partnered with 4 major banks (namely: Standard Bank, Absa, Nedbank and FNB) and in time, other banks (such as Capitec, Investec, Discovery, TymeBank and Standard Chartered) are also expected to also integrate with the new system in the future.

PayShap will allow real-time low-value transactions of up to a maximum of R3,000 for both consumers and small businesses in South Africa. The system aims to eventually replace cash altogether in South Africa.

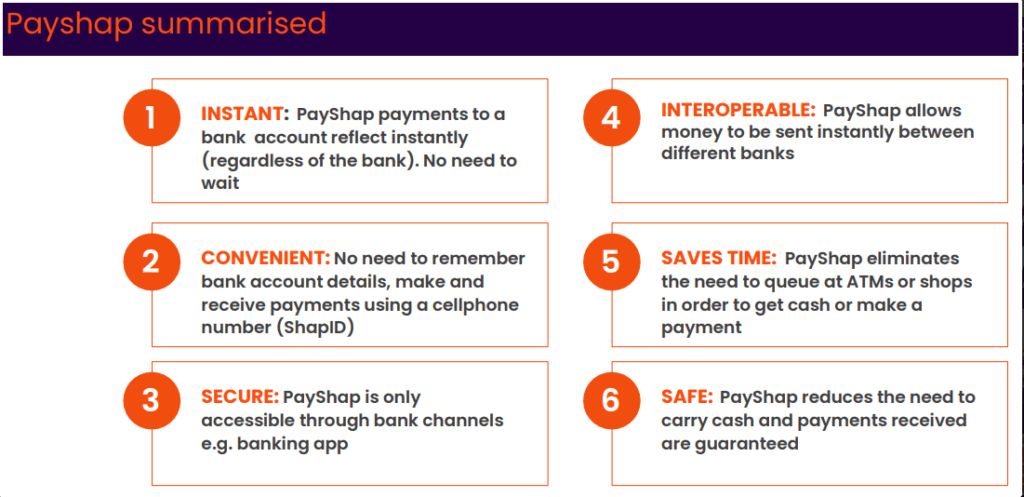

Here are a few benefits of PayShap:

1. Payments are INSTANT

When you pay using PayShap, the money reflects in the recipients account instantly. There is no need to wait for the bank to clear the payment, or pay extra bank charges for an immediate payment. As soon as the transaction is complete, the money is in the recipients account!

2. PayShap is CONVENIENT to use

Simply use your cellphone to make or receive payment – you no longer need to have the recipients banking details on hand to make a payment. Nowadays our cellphones are always within reach, therefore making payment on your cellphone is quick and easy!

3. PayShap is SECURE

You can only access PayShap through official banking channels, such as your banking app on your cellphone. Do not fall for scams – the only way to make payment with PayShap is through your own bank.

READ: PayShap Questions and Answers (Part 1)

4. PayShap is INTEROPERABLE/ COMPATIBLE (able to work with other products or systems)

The app allows users to make instant payments between different banks. Whereas making a payment between different banks (ie Absa to Standard Bank), may usually take a few days to clear, PayShap allows payments to be made instantly between different bank accounts!

5. Payments are EFFICIENT/ SAVE TIME

By using PayShap, you will be able to avoid standing in long queues at the bank or shop in order to make or receive payments. As the saying goes “time is money”, so why waste time standing in a queue when you can get or make a payment in a few seconds using your cellphone?

6. PayShap is SAFE

You will no longer have to carry cash, keeping your money safe! It is well known that crime in South Africa is one of the highest in the world – protect your hard earned money by not carrying cash on you!

If your cellphone is stolen, criminals will not be able to access your PayShap account as it locked within your banking app (which needs your username and password).

READ ABOUT: Types of grants

SRD R350 Grant Care Dependency Grant Child Support Grant Foster Child Grant Disability Grant Older Persons Grant Grant-In-Aid War Veterans Grant

Types of Grants How to Apply Status Check Payment Dates Jobs & Vacancies Updates & Blog Contact SASSA

QUERIES AND CONTACT

For any further queries, please contact SASSA directly:

Contact the SASSA Toll Free Call centre on: 0800 60 10 11

Contact the SASSA Head Office on: 012 400 2322

Email SASSA Head Office at: Grantsenquiries@sassa.gov.za

Contact details of SASSA offices across the country: SASSA contact details